Retirement is a crucial issue that anyone should be planning out for, no matter how busy life becomes. By definition, this is what the merriam-webster dictionary defines retirement:

Definition of retirement

-

b : withdrawal from one's position or occupation or from active working lifec : the age at which one normally retires "reaches retirement in May"

- 2 : a place of seclusion or privacy

From my own study on business & investments, it seems that there are at least 3 types of RETIREMENTS:

1. Minimal or No retirement

- most have not thought about retirement at all, until it is too late

- after "retirement age", they get their ''retirement" from the company or institution they work from, but then they still NEED & HAVE to get more income so they have no recourse but to CONTINUE to work [or depend on their children, which may be OK in the eyes of some people, but may look like be a burden to others]

- you are forced to work or look for other sources of income, because we dont have enough funds, and we are burdened with everyday expenses called "living"; thus, you will need to have recurring income for monthly expenses dependent on the quality of life that you want (whether simple or extravagant)

- unknowingly to some, this is what we need to be prepared for as early as college graduation

2. Retirement at age 60 or 65

- the most common age of retirement

- some Filipinos build proactively for this, but most dont understand that "retirement is not a function of age, but of income"

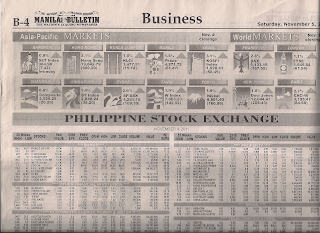

- they build for this, through different ways: SSS, pension plans, insurance, real estate, asset accumulation, investments, royalties, stocks, dividends, profit-sharing ventures, and other options

- it is good to retire at the ripe retirement age, at least they have planned for it, and have enjoyed most of their working life (assuming they have a good secure/stable profession or good corporate life)

- the only REAL question now is how much they will be getting from their retirement plan: will it be enough to sustain their everyday living, or their current lifestyle? To know the answer to this, simply ask people who is on the verge of retirement, or past that, then ask educated/intelligent questions. YOU WILL LEARN A LOT BY ASKING THOSE WHO HAS GONE THRU MOST OF THEIR LIFE YEARS BEFORE YOU.

3. Early retirement

- these are CHOICES made by proactive, very resourceful people; people who investigate, diversify and research ways to build their portfolio or their assets, or at least make a conscious effort to get to their retirement as early as possible

- "daig ng maaga ang maagap"

- some are able to retire as early as their 40's, or even earlier

- a well-known businessman Robert Kiyosaki retired at age 47

- what does it mean by early retirement? You can continue to not do anything, sleep or do anything you want, but still earn enough income to sustain your needs (and wants), depending on the quality of life you CHOSE, not the life you are FORCED TO DEAL WITH

- these are people who prefer this choice than the usual 60 or 65 retirement age, and are very wise to do so

Now, the million-dollar question:

- when you retire, how much earnings do you want to have? how much monthly income?

- do you have children or some circumstances making it hard for you (health challenges, other priorities, etc) which limits you, or requires you to suspend your retirement plans so that your immediate needs must be prioritized first before your lifetime goals or longer term plans?

If yes, the question now is: when do we start putting it off (retirement), and start planning & building for it?

RETIREMENT is important but not urgent (which is classified as a QII activity by Stephen Covey on his time management quadrant, from the book "The 7 habits of highly effective people"), if you are still planning it out. Probably 80% of Filipinos does not have any plans for it until it becomes too late. Most have not found a real purpose.

The real question really is not HOW, but WHY?

If you have a boss who is retiring soon, it is best to work closely with him/her. Not because you want to replace them at their position, but because you want to learn what kind of life you might have once you get to their age, and start planning ahead. You need to have a plan - your current plan at your current work/profession, and your "Plan B".

Ask your life's biggest questions NOW, so you won't have to regret later.

Good luck on your business / investment ventures & adventures - and your future plans for retirement!

Picture credits:

http://pioneerinstitute.org/wp-content/uploads/retirement-next-exit-1024x567.jpg

http://s2.evcdn.com/images/edpborder500/I0-001/038/123/981-4.jpeg_/opsrp-oregon-public-service-retirement-plan-81.jpeg

http://www.ihatedroz.com/wp-content/uploads/2008/12/out-of-toilet-paper-plan-b-300x225.jpg

http://www.tellus360.com/wp-content/uploads/2012/08/what-would-macgyver-do-on-empty-toilet-paper-roll.jpg