A friend of mine once told me (I think this was late last year), "hey Jeng, nagsisi-taasan na ang prices ng stocks ah. Nakita mo ba?"

I thought, parang nasa consolidation pa rin tayo as far as I know [and the current bull run that we have today started just around January or Feb 2012]. So I asked her, "how did you know?"

She said, "nakita ko sa dyaryo.."

She said the price of this certain stock (I think she mentioned SMDC) has hit the roof and is now approaching P20. She caught my attention because, as far as i know from my last check: SMDC is one of the stocks I was following, and it was playing at the P8-P12 range. It could have been nearly impossible that it hit P20 that fast. Plus, during that time, the Europe Crisis was still getting hot.

I asked her, "Are you sure about this?"

She said yes.

I asked again, "how would you know that the stock price has 'hit the roof'?"

She said, "thru the newspapers. She said, it's on the Philippine Daily Inquirer."

"Ok," I said, "so, how then would you know or verify if the newspaper is indeed right."

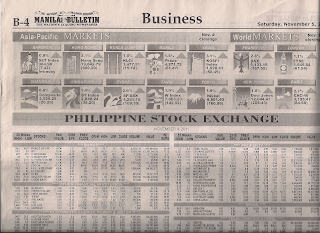

She said the newspaper told so. The headlines says so. "Also, it's listed on a table were all stocks are in there and you will see the current stock price," she added.

I reiterated.. "Ok, from what I know, what's listed in there are the stock symbols, the current stock price, the 52-day hi and low." I asked again, "so how'd you know if the stock 'hit the roof' & is trending up?"

"I guess, the 52-day hi & low?" She was getting a bit unsure of her answer.

I finally told her, you don't easily see that on the news. You have to dig in further. I told her, "All you see is a reporting of what's happened on the previous day of stock action. When you base solely on the news, you're gonna end up getting IN or OUT of a stock at the last moment."

"You've got to know when a stock is trending up or down, why a stock is a bit cheap, why we say it's going up or is reaching it's peak. Yes, you can easily see that on the news, but it's not the whole story. Because if you do, then all the other people who are reading it will jump in and get that stock."

Just imagine people basing on the news and acting on what they see on the news.

All sorts of people just reacting, investing with no solid knowledge or measurable strategy. They are following what has been stated by a newspaper reporter, who may not necessarily be a Market Analyst, Strategist, or maybe not even a stock market investor. People jump in on the stock, with all the craziness, people filled with emotion - with excitement. And then suddenly a smart institutional investor sees the moment and seizes it. It happens. Your hard-earned money: goodbye!

-----------------------

What my friend was seeing in the news is mostly a reflection of only 1 side of the coin. When we talk about the stock market, we could say we have 2 main schools of thought or approaches - 1) those who look at the perceived value of a stock based on the company's earnings and performance, which we call the "fundamental" aspect; and 2) those who look primarily at the movements of the stock price (using stock charting) to outline the performance of a stock, which is the "technical" aspect.

Who am I to say this? Am I an authority or certified analyst? Well, no. I am not a big expert (yet) on stocks, I'll be honest: I did gain some & lose some, but at least I know the basics. And I try everyday to learn and expand my knowledge on everything about business and investing, including the darling Stock Market.

That is why when investing in stocks (or in any kind of business and investing, in general), I say, we also need to educate ourselves, do our own study, do our own research & readings. There are a lot of guys out there who can help. Bo Sanchez, whom I'm sure a lot of Filipinos know about, has a blog at "

BoSanchez.ph". He conducts seminars regularly.

Let me show you a free e-book from Brother Bo.... "My maid invests in the Stock Market".

My Maid Invests in the Stock Market…

He is one of my mentors and I check on his blogs and seminars from time to time.

Also, my stockbroker, CitisecOnLine (COL) gives out trainings and seminars on investing in the Stock Market (which covers both the Fundamental and the Technical Aspect).

If you want to start looking at more aggressive options like the Stock market, I suggest you start with those.

Because I know, from learning from these mentors, that both the Fundamental and the Technical aspects are very important in determining stock price action, as well as in your decisions as to which stock or company you're gonna get invested in. How you could gain money on the stock market, or make it work for you so that you get earnings, or even passive income.

I'm not here to be very technical about this, and I'm also not gonna cover a lot about the Fundamental Analysis aspect.. but I will only show, again, the 'basics' of what they call Technical Analysis, or the scientific or organized study of stock price action.

The basics of Technical Analysis include:

- How to know if the current price that we see on the news is a good price (or, in terms of fundamental lingo, a "cheap" price) to get in

- How to know if the price is trending up, or down

- How to know if we are in a bull market, or a bear market (they say you are either bullish, or bearish - which is essentially the outlook or the risk appetite of the investor)

The topics in Technical Analysis is so wide-ranging, and I tell you - it could be very dangerous if you only cover a few and not all of the basics.

Just a disclaimer: what I'm gonna be showing you is just a few of the basics, hopefully I can cover some others in later posts.

On the other hand, the "fundamental analysis" aspect, in it's purest form, is different in that it doesn't rely on charts and graphs. It relies on price-to-earnings ratio, the earnings of the company (say in the last 4 quarters, or the last quarter, or assessments in the 1st or 2nd half of the year), if a company is indeed earning something, does a company have debt or incurred some losses, do they have incoming big projects that could boost it's stock value, etc.

Here is a tool that fundamentalists use:

Yep. I know, it's a newspaper. It's a basic tool. But I'm not saying it's not important. All the data in there are very very valuable,

if you know how to use it. I'm saying that sometimes, you don't get the whole story with a full-page listing of the current stock prices.

The main difference, now, is that Technical Analysis uses charts & graphs. It uses projections graphically, using charts to see and justify those projections. Some higher topics even use formulas, and

Da Vinci codes (no, I'm just kidding; but it's a bit true because they have what they call Fibonacci retracements).

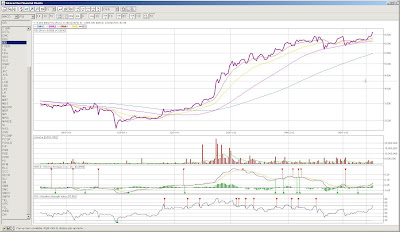

Here is a sample tool of what Technical Analysts use. This is what they call a "Stock Chart" (this picture is our current Philippine Stock Composites Index, or PCOMP, at the time I wrote this post):

Technical Analysis basically says the value of a stock (from what the Fundamentalists state as the perceived price or fair value) is already priced-in on the 'stock-price' which we can squarely see on the charts, meaning if the stock did not perform well fundamentally, say: it didn't earn last quarter or has incurred some losses, it will show on the charts sooner or later. It will show that the stock price is gonna drop eventually.

That a movement on the price has some sort of a justification. Like for example, if a stock has suddenly moved up for no apparent reason, so that even fundamentalists can't explain it (say, a mining company just moved up so quick). Be careful because sooner or later that price is gonna drop. Nothing can sustain a momentum if that momentum has no substance.

Wow. I didn't realize that it's gonna take that long for me to explain things. But I just wanted to let people know that I want to be careful in describing abstract or intangible things, because I don't want to be an irresponsible writer who will get the ire of people. I want to explain the things I learn from my mentors as best as I can, and in the language that I know.

I consider myself still starting at business and investing, although I've been doing stocks for about 2 yrs already. I can be wrong at times (especially when I get to state some stocks which I think would be good to pick - if that happens in the future), but it's important to point out the things that already have a foundation, or, like what Stephen Covey says "a map of the reality, not the territory" - those things that are based on principles and are widely-considered as true, correct or objective. Just like the 2 schools of Stock Market Investing.

You can either be a pure fundamentalist, or a pure technical analyst. You can have balance between the two (which should be the correct way for most people, I should say - especially for those who are still starting & learning, or those who prefer less risks or those who have low-risk appetites or preferences), but these two are totally distinct and different approaches to Stock Market investing.

Sorry, I don't have anymore time for now. I will continue with this tomorrow, or as soon as possible, and try to evaluate the stock market (based on what COL has presented last night on their 2012 Stock Market Outlook), and how, like I said before, we will try to see Solar Systems as possibly a profitable investment - or may be a safer investment than most stocks, using charts analysis.