On my very 1st post in this blog – I posted something about the Billionaire Wealth Building Formula. This formula was actually something I heard from a real estate seminar, which, now that I’ve really thought about it – actually originated from a simple idea from a simple book that til now has really stuck in my mind and which I still learn / apply and try to follow until this day. I’m talking about Robert Kiyosaki and his ground-breaking books on the Cashflow Quadrant. Particularly in the book Rich Dad Poor Dad, he talked about the SINGLE, MOST IMPORTANT secret of the wealthy, the one which he says we should remember out of all the principles he was teaching in his books – and that is: “the secret of the rich is to build and build ASSETS, and minimize liabilities”. It’s simple, yet insightful – and true to the core, even in real life. It’s not just some superficial marketing slogan. This is what he stated:

Rule One. You must know the difference between an asset and a liability, and buy assets. If you want to be rich, this is all you need to know. It is Rule No. 1. It is the only rule. This may sound absurdly simple, but most people have no idea how profound this rule is. Most people struggle financially because they do not know the difference between an asset and a liability. "Rich people acquire assets. The poor and middle class acquire liabilities, but they think they are assets".

Build and acquire assets. That is “all you need to know”, he says. If there are assets that you can build which does not give out negative returns or liabilities – the better. One asset which a normal person would usually think of is land or property, which you can define as a very good asset, especially when you talk with a bank and ask for loans or get more capital for your business. It serves as a collateral. But it does have liabilities – or taxes, which you should pay sooner or later.

The fact is: there are assets out there that give out

minimal liabilities. I know of people who has rental property – it’s a very

good asset, although usually there are risks (what business doesn’t have any

risk?). Depending on how you control and manage the risks – the idea of this “real

estate” asset is what I would not hesitate sharing and recommending to my

closest friends. Because it’s proven to generate real income to the investor /

business owner.

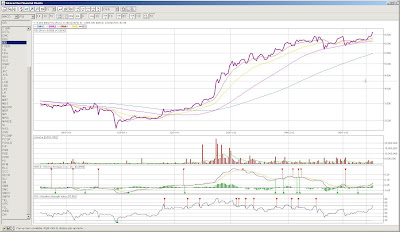

Another one good asset is a stock portfolio that you fully

understand, and where you have a very sound strategy. I’m part of a group that

recommends sound analysis (fundamental and technical analysis) on current

trends and stocks today. I still follow

them this day from time to time, but this investment vehicle is something you

really need to study – or else, you WILL get risks (or losses – meaning: MONEY),

if you don’t know what you are doing. It’s something you also need to commit to

and be devoted on, watching your stocks and your money grow, everyday, if you

can. Yes - there is money here (see

link: http://investinggeek.blogspot.com/2012/07/jackpot-on-eei.html).

It’s proven to be real, and people in the Philippines are having phenomenal

unprecedented growth especially NOW, in the young history of our stock market. But

with this financial vehicle, it will depend on how you manage and embrace risk.

It depends on what market analysts usually state as your “RISK APPETITE”.

Because in stocks – you will have to understand and fully accept – you will

have to lose money, short-term, mid-term, long-term: you will need to learn how

to accept it INTENTIONALLY, in order for your money grow to where you want it

to be.

These are just some samples of good assets that you can look

out for. Although.. I have not even began talking about some other real ASSETS

that some real wealthy people have, from what I’ve found out, that DOESN’T HAVE

ANY liabilities. Some people even have an asset, that grows exponentially so

that their money will never dry up – and some are in financial vehicles that

are over-capitalized that their business are bigger and even more stable than

the banks.

I’m talking about assets that people really work hard for – they

build their businesses and build a foundation, so that soon they will reap the

benefits after a certain time (sometimes, even in just 2,5, 10 years). And when the time comes or when the

asset is “ripe”, you would have setup a system which gives you stable wealth

(enough money, enough time for yourself or your family, travel, fulfilled

dreams, etc.) – so that you will just earn the benefits of your hard work day

in and day out, even when you sleep. Leave it 6 months, 1 year – go on

vacation, and you will still reap the rewards of that asset. Yes, you can call

it early retirement.

There are assets that have very minimal risk (and even some

with ZERO CAPITAL to start up), and doesn’t have liabilities. Some assets

doesn’t even need more capitalization, doesn’t need your money / capital /

investment because it’s already over-capitalized (I just recently heard that

term, and really liked it).

Yes, sounds too good to be true. But it is true. I’ve seen

people do it. I’ve met, or sometimes consult, associate, and even work on some

projects with people who has done it. I ask for advice and for their point-of-views,

or simply ask everyday life questions, when I get the chance. And even in our

everyday lives - you see people do it, it’s all in the news. Business section.

There are people who become self-made millionaires just with

a dream and a passion. Just think about it, and observe your environment now -

Henry Sy did it when he established his system of chain stores and malls. He

risked a lot in the beginning, and dreamed. From what I know, the story was

that he usually goes to some trips to Tagaytay, up the hills / viewing decks

overlooking the mountains and the lake, and was amazed at the vast lands below

him (read the wall on Taal Vista). That is where he formed and dreamed about

his vision. And now, he has buildings and malls all over the place (where he

once was looking at). And it’s not just in Batangas or Laguna, or the area

below Tagaytay. He has establishments all over the archipelago. Now, he is the

richest person in the Philippines. What did he do in the beginning? He was in

the distribution business. He moved shoes.

And now, most importantly, he has an asset that he has

built, and a legacy that he gives out to his children and grandchildren. Who

doesn’t want a life where he can give the best options for his kids, his sons/daughters

and grandchildren? Yes, he paid dearly in the beginning, worked hard, and worked

smart. Now he is reaping the benefits from his hard work, even when he sleeps

all day. Because he has built an asset.

From what I have found out on my own and continually see on my ongoing

search for good and sound businesses / investments (yeah - you could say I’m an

investing geek --better call me an ASSETS geek now), that dream life you have

dreamed of is really not impossible. You just have to educate and open up your

mind to the possibilities, start with educating yourself financially, and start

with reading books about money, businesses and investing. Instead of looking at

the Headlines page, where you will usually see grim and negative broadcasts, go

straight to the business page. Yeah – stock A and B soared. Real Estate is booming.

Inflation rate is going steady. If you don’t know these yet - ask why: research

reliable sources, look for and associate with reliable people.

Search for that asset. That ultimate asset, the asset that

will work for you – and most especially, continually look for an asset that will

give zero liabilities so you can fast track to your financial freedom. You will find yourself educated and gaining more knowledge,

and believing even more that you will get to your dream life even while being

in that process of searching. Sometimes you will fall, but the important thing

is to move back up and continue on your journey.

Just be educated yourself, and take a little risk by looking,

examining and searching for that asset. Be open with any opportunities that

come your way. Who knows? You just might suddenly stumble into a real good one –

but when you see it, don’t just step on it, don’t leave any stone (or opportunity)

unturned. Pick it up, and investigate. If it’s a franchise, talk to the

franchisee. Check and talk directly with people who are doing it (and have

succeeded in it) to see if it’s a real deal. You just need a proper

investigation, to observe and learn – and most especially, always check your

risk appetite. Is this something you can really do? Is it worth the risk, going

out of your way - out of your comfort zones? What does the people who succeeded

in that business or has gotten results in their investments say? What would have

“rich dad” said?

If your dream is bigger than your fears – there is NO risk

you can never overcome. You can find, you can search, and you can build those

assets. You just need to figure it out yourself… don’t just say “I can’t (afford)

it.” Ask: “how can I (afford) it?”

The fact of the matter is: whether your goal is simply to

get by, to bring food to the table, to bring your kid to the most prestigious school,

or to become a paragon of real positive change – then you will need money. Bro.

Bo Sanchez once said – if you are to serve in your church, you need money to

help your church in their outreach projects (and also to help ensure that

church or religious organization continues to operate and “support the supporters”).

The current reality is: even priests or pastors need money to be able to serve

and effectively do their duty. Everybody eats, everybody drinks, and everybody sleeps.

Bo Sanchez aptly stated it: money is not really the root of all evil – love of

money is.

So read on. Come with me and let’s look at our options.

Let’s do a search for that ultimate asset, so that one day we’ll be able to

have more, do more, and be more.

What will you really

do for your dreams? Will you change something, or remain where you are - hoping

that your dream will come right at your door? Have you really thought about it, or have you already given

up on your dreams and just gone on living the way you are now?

Photo credits: http://www.mergersandinquisitions.com/hedge-funds-institutional-asset-management/