|

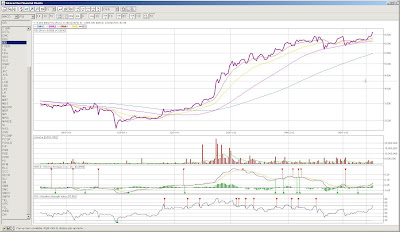

| EEI stock on PSE - back when it was still about to trend higher up |

A friend of mine recently asked me this question via FB:

may tanong ako sa stock investing. i'm following bo sanchez's stock updates. i buy when low. then napansin ko nawala ang gains ko because i kept on buying at buy below prices pero dahil tumataas na ang price per share, tumataas din ang average prices ko. for ex. MBT. dati ang average price ko was 69. i noticed na may gain nako na almost 50% when MBT price per share went up to over 100. but i held on to my stocks. i kept on buying and the ave price went up to 72 na and my gains were now barely 30%, also because share prices pulled back from 100 to 92. sana pala nagbenta nako nung nag 100 ang price. but i haven't sold any MBT stocks.

so i experimented today. i observed na tumaas ang FPH up to 80/share and i noticed na may gains nako na 23%. 80 is still below the buy-below price of 102. what i did was i sold all of my FPH shares and i plan to buy again when it pulls back a bit so i can start from 0, so to speak. i plan to do range trading pero guided by bo sanchez's recommendations pa din. am i doing the right strategy? i'm thinking kasi na as long as i see positive gains, that means i'm earning di ba?

that's what i did with ICT. nag experiment ako. a few months ago, i read in COL research that ICT shares are at market values at 71-75/share. so they recommended to buy when prices pull back to 67. and it did! well i bought at 67.50 and it went up to 71 kanina lang. so good move. pero i only bought up to 250 shares lang coz i was scared to lose my money so ang kinita ko was barely 600 bucks hehehe. better than negative.

Here is my answer:

Hi (friend), nice read !

I think for MBT, what you were doing was Peso Cost averaging right? That's actually normal, as you accumulate per month or per same period of time at the same amount, the average goes up as the price that you get to buy them also goes up. If you really want long term for MBT, then you can continue to buy and be consistent on the Cost Ave Method. Although 50% is already a very good one.

For FPH, I think you are doing just right. Although if you plan to range trade, yes follow Bo's recommendation. Try to understand the reason why -- the reasoning is: BUY in DIPS. If it dips down low, you buy. If it goes up and reaches a peak you set as your target, you can sell. Take NOTE though -- this kind of market timing is hard, you will need in-depth knowledge or experience and application of technical analysis. YOu have to be careful -- make sure that the mid-term or long-term outlook is UPTREND (range trading is generally used for stocks on a consolidating trend). You will see it through the charts. You will really have to apply what you learn in tech analysis to get proper timing. To be extra safe, make sure you are riding on a fundamentally-sound stock. I haven't been following FPH, but from what I've heard ever since, from COL fundamental outlook, they've been consistently grading it naman as a fundamentally good company.

For your ICT -- that's good! Any positive gain is good. I've heard somebody term themselves"chupitero". But any gain in the stock market is a good gain - kahit gano pa kababa (or kaunti). Kahit pa binteng lang! So I agree with them. A chupitero is a chupitero -- he is still.... panalo! hehe

We may be getting gains now, but gaining in stocks is not really that easy. Once you get losses, you'll know how it feels like. But -- no pain, no gain. You may loss some, but if you know how to handle it well, and know how to use that pain to really learn something -- you will gain in experience. That is, to me, what will give you the golden eggs.

---------------------------------

Happy Investing to all! ;)