Knowing the basics of wais-investing in the Philippines. Let’s share knowledge, gain wisdom, learn skills and build Millionaire Habits in Personal Finance, Business and Investing.

Thursday, March 29, 2012

The 2 Stock Market Approaches that Most People Don't Know About [and how we can use one of them to evaluate a Solar Investment] - Part 2

Hi everyone!

I sincerely apologize for having gone for so long, when I promised I will expand further on my earlier post:

The 2 Stock Market Approaches that Most People don't know about [and how we can use one of them to evaluate a Solar Investment] - Part 1.

It takes time for me to write, it can be mentally and emotionally draining because I write not just to do SEO or SEM (hello, internet geeks!) or promote myself. I put my heart & soul into it, and I try to make sure I will be responsible & objective as I can.

Anyway, let me give a quick lookback.

At my earlier post, I said that the basics of Technical Analysis include:

- How to know if the current price that we see on the news is a good price to get in

- How to know if the price is trending up or down

- How to know if we are in a bull market or a bear market

I will try to answer all these questions, using the stock charts that we have for our PCOMP or Philippine Composite Index.

Also, I'd like point out - as early as now - there may be people who may start asking why I'm divulging information that could be detrimental to their strategies. Or, some people may get overly paranoid saying, "Oh no! This guy is spilling out the secrets!"

Well, sorry.. but these are not secrets. There are a lot of resources out there. A few of which are here:

http://www.swing-trade-stocks.com/stock-market-books.html

Technical Analysis of Stock Trends by Robert D. Edwards and John Magee

Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications

[If you know of some great links or websites or books, please share them!]

Okay, so let's get on with it.

How to know through Stocks Charts that a stock is trending up/down (or bullish/bearish), or consolidating

Know your Trade Horizon

First, they say in life, as well as with business or investments, you have to KNOW THYSELF.

So, the very first question to ask then, is not "hey, could you tell me a stock I could pick now and tell me if it's trending up or down, so I could gain quickly". Hey, get-rich-quick-schemer, get outta here. I'm not here to do magic.

The right question, I guess for me, is this:

What is your RISK appetite?

Are you a trader, or doing it short-time?

Gusto mo ba maka-syota si LC, or si MEG Ryan?

Or, are you an investor, or doing it mid-term to long-term?

Ang gerlprenin/boyprenin o asawain si BELla, sTELla, or si MERyl Streep?

It doesn't actually matter if you are classifying yourself as such (trader or investor), the important thing here is that you know what your trade horizon is. Meaning, how do you look at your investments? Do you have a short-term or longer-term outlook?

If you find this hard to answer, saying "depende po e, minsan short term ako, na kapag natatalo na sa short-term nagiging long-term na po ako."

(Well, if this is your outlook, I don't think this is a good strategy po sir / ma'm.)

What is your Risk Appetite?

Okay... Let's try another question: Hanggang saan ang kaya ninyo i-risk?

Or: ok lang po ba sa inyo na iiwan ninyo ang stock investment ninyo for a year na hindi ito nagagalaw? Or, for a few months lang ang kaya mo? Or, maybe a few weeks, or a few days lang ba?

Or baka po 'di na kayo mapakali, after a few days, 'di ka na mapigil na tignan ang stocks portfolio mo kada oras (kahit sarado ang stock market).. "ano, kumita na ba ako?? Nagbago na ba, umakyat na ba presyo?"

Kung ayan po ang symptoms ninyo.. baka po ibig sabihin ay more on short-term kayo. Or, pwede rin na nag-start pa lang talaga kayo at natututo pa lang, at di nyo pa gaano napag-iisipan.

So, by this, we could say your investment horizon can be determined by your risk appetite. If you are comfortable leaving your money invested on a stock, having studied and carefully researched on the company you chose, say in a few months or a few years - then you may have a longer term outlook. Also, those who prefer cost averaging methods look at a longer term return for their investment.

To make it short, you have to know yourself, and understand if you are here thinking on a short-term, mid-term or long term outlook.

So, in Technical Analysis, if you have a short-term outlook, you would probably look at the stock charts in DAILY or in WEEKLY views, or in 3 months, or maybe til 6 months views. For a longer-term outlook, you probably will look at the charts from time to time, and look more at 3-months, to 6-months, 1-year to 5-year charts.

Here is a sample for 3 months, running from January until March 2012:

You could see here that the Philippine Stock Market has been trending up and getting hot since January. The purple line on the graph, we could say, is the movement of the Stock Price (although my sample is the Philippine Composite or PCOMP index, so this is not a particular stock or company, but a set of companies composed together to form a composite or an index - it's like an average of all the stocks, from small caps to large cap stocks including blue chip stocks, so it could better represent the status of the Philippine Stock Market).

For now, let's not look at the graphs saying Volume, MACD, or RSI.

Here is a sample for 6 months, running from October 'til March 2012:

We could see here, through the purple line, that the Philippine Stock Market slowed down a bit from mid-October 'til about the end of the year.

Next Important Question: How do you know if a stock is going up or down?

To answer this question, we have to define what is a TREND, then know what trendlines mean in Technical Trading.

Well, I don't know the formal definition of a trend, but it is similar to what they say in the news about a trending topic. Meaning pinaguusapan, or umuuso. But with this, we could also mean something is hindi na pinaguusapan, or nalalaos na.

So in stocks investing, when we talk about a trend, it simply means the stock is following a pattern. It is either going up or down. In technical analysis, we could easily see this in the charts. We could say a stock is going on an uptrend or a downtrend.

Let's use the Philippine stocks composite as our sample, this time using a 5-year sample chart:

Again, let's not look at the graphs saying Volume, MACD, or RSI for now.

Samples of Uptrends or Bullish trends:

On the graph above, I've indicated 3 instances of uptrends in the Philippine Stock Market for a 5-year period, indicated by the red lines. Try comparing the original graph with the one I've just shown above so you'll see what I mean.

These red lines are what we call the trendlines. Technical Analysts draw this on a graph (like the one above) so it would be easier to study their next moves and get projections. The graph that I use here is not an ordinary graph or stock chart. Try to look for Stock Chart apps or programs out there for your preferred PC operating system or mobile gadget. For me, I prefer using my Windows PC. The app that I use is from my online stock broker, CitisecOnline.com - a java chart is provided on their website when you become a member.

Downtrends or Bearish trends:

You'll know we are on a downtrend if we see all sorts of bad news and panic in the business section of our daily newspapers, sometimes echoing whatever is happening on other stock markets - especially the US stock market.

Technically Speaking

In technical analysis, we could further define and more aptly state what an uptrend or a downtrend is.

Using a chart, we could see that an uptrend is characterized by a series of higher highs (HH) and higher lows (HL).

On the other hand, a downtrend is characterized by a series of lower highs (LH) and lower lows (LL).

In pictures or graphs:

Try going back on the charts that I've shown and try to see why I said it was an uptrend, or a downtrend.

My post is getting long. I have to cut it for now. Next time we'll see what it means by what the newspapers or stock market experts sometimes say as "consolidating", during times when our Philippine Stock Market is on a consolidation period.

Friday, March 23, 2012

Commercial: Usapang Pulitika Muna (on Chief Justice Corona)

Eto po ay bigla bigla nai-comment ko sa 1 yahoo news regarding sa trial ni Chief Justice Corona...

"Tama. Tama lang na makibahagi at makilahok sa usapang pangmamamayan, panlipunan at pang-sambayanan. Pero dapat wag na lang masyado pa-apekto.. Hayaan nyo silang maghusgahan, habang tayo naman e magpapayaman muna ng sarili sa isip, at sa pinansya. Kayang magbago ng Pilipinas, kayang bumangon. Magsisimula ito sa atin rin lang, sa ating self-emancipation at self-education.

Gumaganda na ang pilipinas, nakikita na paunti-unti na meron na ring mga proseso. Kaya mag-self-educate na lang at mag-aral ukol sa pinansya. Hayaan muna natin sila dumaan sa sariling mga proseso na nakikita naman na natin ngayon.

The Philippine's Chief Justice Corona on Impeachment Trial

Pero ano ba ibig sabihin nuon? Titigil na tayo? Na sira na totally ang Pilipinas, na wala nang integridad ang batas natin? Si Corona lang ba ang Judge natin, hindi ba magkakaroon naman ng panibagong Chief Justice after a few years? Dapat nga lang matuto rin tayo sa mga mali. Ano man ang mangyari dito sa trial na to, dapat matutunan natin at masusi pag-aralan at sikaping wag maulit muli.

Nagsisimula pa lang tayo bilang isang bansa, bata pa tayo ika nga. Marami pa tayo dapat matutunan bilang demokrasya. Dapat maintindihan natin na lahat ay me pinagdadaaanang natural stages of growth. Kahit ang isang bansa. It can be slow and painful, but nonetheless - it's real growth.

- InvestingGe3k"

Nagsisimula pa lang tayo bilang isang bansa, bata pa tayo ika nga. Marami pa tayo dapat matutunan bilang demokrasya. Dapat maintindihan natin na lahat ay me pinagdadaaanang natural stages of growth. Kahit ang isang bansa. It can be slow and painful, but nonetheless - it's real growth.

- InvestingGe3k"

Wednesday, March 21, 2012

The 2 Stock Market Approaches that Most People don't know about [and how we can use one of them to evaluate a Solar Investment] - Part 1

A friend of mine once told me (I think this was late last year), "hey Jeng, nagsisi-taasan na ang prices ng stocks ah. Nakita mo ba?"

I thought, parang nasa consolidation pa rin tayo as far as I know [and the current bull run that we have today started just around January or Feb 2012]. So I asked her, "how did you know?"

She said, "nakita ko sa dyaryo.."

She said the price of this certain stock (I think she mentioned SMDC) has hit the roof and is now approaching P20. She caught my attention because, as far as i know from my last check: SMDC is one of the stocks I was following, and it was playing at the P8-P12 range. It could have been nearly impossible that it hit P20 that fast. Plus, during that time, the Europe Crisis was still getting hot.

I asked her, "Are you sure about this?"

She said yes.

I asked again, "how would you know that the stock price has 'hit the roof'?"

She said, "thru the newspapers. She said, it's on the Philippine Daily Inquirer."

"Ok," I said, "so, how then would you know or verify if the newspaper is indeed right."

She said the newspaper told so. The headlines says so. "Also, it's listed on a table were all stocks are in there and you will see the current stock price," she added.

I reiterated.. "Ok, from what I know, what's listed in there are the stock symbols, the current stock price, the 52-day hi and low." I asked again, "so how'd you know if the stock 'hit the roof' & is trending up?"

"I guess, the 52-day hi & low?" She was getting a bit unsure of her answer.

I finally told her, you don't easily see that on the news. You have to dig in further. I told her, "All you see is a reporting of what's happened on the previous day of stock action. When you base solely on the news, you're gonna end up getting IN or OUT of a stock at the last moment."

"You've got to know when a stock is trending up or down, why a stock is a bit cheap, why we say it's going up or is reaching it's peak. Yes, you can easily see that on the news, but it's not the whole story. Because if you do, then all the other people who are reading it will jump in and get that stock."

Just imagine people basing on the news and acting on what they see on the news.

All sorts of people just reacting, investing with no solid knowledge or measurable strategy. They are following what has been stated by a newspaper reporter, who may not necessarily be a Market Analyst, Strategist, or maybe not even a stock market investor. People jump in on the stock, with all the craziness, people filled with emotion - with excitement. And then suddenly a smart institutional investor sees the moment and seizes it. It happens. Your hard-earned money: goodbye!

-----------------------

What my friend was seeing in the news is mostly a reflection of only 1 side of the coin. When we talk about the stock market, we could say we have 2 main schools of thought or approaches - 1) those who look at the perceived value of a stock based on the company's earnings and performance, which we call the "fundamental" aspect; and 2) those who look primarily at the movements of the stock price (using stock charting) to outline the performance of a stock, which is the "technical" aspect.

Who am I to say this? Am I an authority or certified analyst? Well, no. I am not a big expert (yet) on stocks, I'll be honest: I did gain some & lose some, but at least I know the basics. And I try everyday to learn and expand my knowledge on everything about business and investing, including the darling Stock Market.

That is why when investing in stocks (or in any kind of business and investing, in general), I say, we also need to educate ourselves, do our own study, do our own research & readings. There are a lot of guys out there who can help. Bo Sanchez, whom I'm sure a lot of Filipinos know about, has a blog at "BoSanchez.ph". He conducts seminars regularly.

Let me show you a free e-book from Brother Bo.... "My maid invests in the Stock Market".

My Maid Invests in the Stock Market…

He is one of my mentors and I check on his blogs and seminars from time to time.

Also, my stockbroker, CitisecOnLine (COL) gives out trainings and seminars on investing in the Stock Market (which covers both the Fundamental and the Technical Aspect).

If you want to start looking at more aggressive options like the Stock market, I suggest you start with those.

Because I know, from learning from these mentors, that both the Fundamental and the Technical aspects are very important in determining stock price action, as well as in your decisions as to which stock or company you're gonna get invested in. How you could gain money on the stock market, or make it work for you so that you get earnings, or even passive income.

I'm not here to be very technical about this, and I'm also not gonna cover a lot about the Fundamental Analysis aspect.. but I will only show, again, the 'basics' of what they call Technical Analysis, or the scientific or organized study of stock price action.

The basics of Technical Analysis include:

- How to know if the current price that we see on the news is a good price (or, in terms of fundamental lingo, a "cheap" price) to get in

- How to know if the price is trending up, or down

- How to know if we are in a bull market, or a bear market (they say you are either bullish, or bearish - which is essentially the outlook or the risk appetite of the investor)

The topics in Technical Analysis is so wide-ranging, and I tell you - it could be very dangerous if you only cover a few and not all of the basics.

Just a disclaimer: what I'm gonna be showing you is just a few of the basics, hopefully I can cover some others in later posts.

On the other hand, the "fundamental analysis" aspect, in it's purest form, is different in that it doesn't rely on charts and graphs. It relies on price-to-earnings ratio, the earnings of the company (say in the last 4 quarters, or the last quarter, or assessments in the 1st or 2nd half of the year), if a company is indeed earning something, does a company have debt or incurred some losses, do they have incoming big projects that could boost it's stock value, etc.

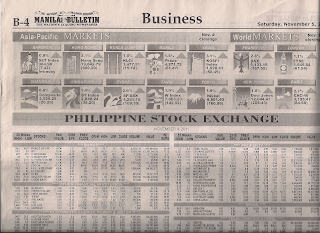

Here is a tool that fundamentalists use:

Yep. I know, it's a newspaper. It's a basic tool. But I'm not saying it's not important. All the data in there are very very valuable, if you know how to use it. I'm saying that sometimes, you don't get the whole story with a full-page listing of the current stock prices.

The main difference, now, is that Technical Analysis uses charts & graphs. It uses projections graphically, using charts to see and justify those projections. Some higher topics even use formulas, and Da Vinci codes (no, I'm just kidding; but it's a bit true because they have what they call Fibonacci retracements).

Here is a sample tool of what Technical Analysts use. This is what they call a "Stock Chart" (this picture is our current Philippine Stock Composites Index, or PCOMP, at the time I wrote this post):

Technical Analysis basically says the value of a stock (from what the Fundamentalists state as the perceived price or fair value) is already priced-in on the 'stock-price' which we can squarely see on the charts, meaning if the stock did not perform well fundamentally, say: it didn't earn last quarter or has incurred some losses, it will show on the charts sooner or later. It will show that the stock price is gonna drop eventually.

That a movement on the price has some sort of a justification. Like for example, if a stock has suddenly moved up for no apparent reason, so that even fundamentalists can't explain it (say, a mining company just moved up so quick). Be careful because sooner or later that price is gonna drop. Nothing can sustain a momentum if that momentum has no substance.

Wow. I didn't realize that it's gonna take that long for me to explain things. But I just wanted to let people know that I want to be careful in describing abstract or intangible things, because I don't want to be an irresponsible writer who will get the ire of people. I want to explain the things I learn from my mentors as best as I can, and in the language that I know.

I consider myself still starting at business and investing, although I've been doing stocks for about 2 yrs already. I can be wrong at times (especially when I get to state some stocks which I think would be good to pick - if that happens in the future), but it's important to point out the things that already have a foundation, or, like what Stephen Covey says "a map of the reality, not the territory" - those things that are based on principles and are widely-considered as true, correct or objective. Just like the 2 schools of Stock Market Investing.

You can either be a pure fundamentalist, or a pure technical analyst. You can have balance between the two (which should be the correct way for most people, I should say - especially for those who are still starting & learning, or those who prefer less risks or those who have low-risk appetites or preferences), but these two are totally distinct and different approaches to Stock Market investing.

Sorry, I don't have anymore time for now. I will continue with this tomorrow, or as soon as possible, and try to evaluate the stock market (based on what COL has presented last night on their 2012 Stock Market Outlook), and how, like I said before, we will try to see Solar Systems as possibly a profitable investment - or may be a safer investment than most stocks, using charts analysis.

I thought, parang nasa consolidation pa rin tayo as far as I know [and the current bull run that we have today started just around January or Feb 2012]. So I asked her, "how did you know?"

She said, "nakita ko sa dyaryo.."

She said the price of this certain stock (I think she mentioned SMDC) has hit the roof and is now approaching P20. She caught my attention because, as far as i know from my last check: SMDC is one of the stocks I was following, and it was playing at the P8-P12 range. It could have been nearly impossible that it hit P20 that fast. Plus, during that time, the Europe Crisis was still getting hot.

I asked her, "Are you sure about this?"

She said yes.

I asked again, "how would you know that the stock price has 'hit the roof'?"

She said, "thru the newspapers. She said, it's on the Philippine Daily Inquirer."

"Ok," I said, "so, how then would you know or verify if the newspaper is indeed right."

She said the newspaper told so. The headlines says so. "Also, it's listed on a table were all stocks are in there and you will see the current stock price," she added.

I reiterated.. "Ok, from what I know, what's listed in there are the stock symbols, the current stock price, the 52-day hi and low." I asked again, "so how'd you know if the stock 'hit the roof' & is trending up?"

"I guess, the 52-day hi & low?" She was getting a bit unsure of her answer.

I finally told her, you don't easily see that on the news. You have to dig in further. I told her, "All you see is a reporting of what's happened on the previous day of stock action. When you base solely on the news, you're gonna end up getting IN or OUT of a stock at the last moment."

"You've got to know when a stock is trending up or down, why a stock is a bit cheap, why we say it's going up or is reaching it's peak. Yes, you can easily see that on the news, but it's not the whole story. Because if you do, then all the other people who are reading it will jump in and get that stock."

Just imagine people basing on the news and acting on what they see on the news.

All sorts of people just reacting, investing with no solid knowledge or measurable strategy. They are following what has been stated by a newspaper reporter, who may not necessarily be a Market Analyst, Strategist, or maybe not even a stock market investor. People jump in on the stock, with all the craziness, people filled with emotion - with excitement. And then suddenly a smart institutional investor sees the moment and seizes it. It happens. Your hard-earned money: goodbye!

-----------------------

What my friend was seeing in the news is mostly a reflection of only 1 side of the coin. When we talk about the stock market, we could say we have 2 main schools of thought or approaches - 1) those who look at the perceived value of a stock based on the company's earnings and performance, which we call the "fundamental" aspect; and 2) those who look primarily at the movements of the stock price (using stock charting) to outline the performance of a stock, which is the "technical" aspect.

Who am I to say this? Am I an authority or certified analyst? Well, no. I am not a big expert (yet) on stocks, I'll be honest: I did gain some & lose some, but at least I know the basics. And I try everyday to learn and expand my knowledge on everything about business and investing, including the darling Stock Market.

That is why when investing in stocks (or in any kind of business and investing, in general), I say, we also need to educate ourselves, do our own study, do our own research & readings. There are a lot of guys out there who can help. Bo Sanchez, whom I'm sure a lot of Filipinos know about, has a blog at "BoSanchez.ph". He conducts seminars regularly.

Let me show you a free e-book from Brother Bo.... "My maid invests in the Stock Market".

My Maid Invests in the Stock Market…

He is one of my mentors and I check on his blogs and seminars from time to time.

Also, my stockbroker, CitisecOnLine (COL) gives out trainings and seminars on investing in the Stock Market (which covers both the Fundamental and the Technical Aspect).

If you want to start looking at more aggressive options like the Stock market, I suggest you start with those.

Because I know, from learning from these mentors, that both the Fundamental and the Technical aspects are very important in determining stock price action, as well as in your decisions as to which stock or company you're gonna get invested in. How you could gain money on the stock market, or make it work for you so that you get earnings, or even passive income.

I'm not here to be very technical about this, and I'm also not gonna cover a lot about the Fundamental Analysis aspect.. but I will only show, again, the 'basics' of what they call Technical Analysis, or the scientific or organized study of stock price action.

The basics of Technical Analysis include:

- How to know if the current price that we see on the news is a good price (or, in terms of fundamental lingo, a "cheap" price) to get in

- How to know if the price is trending up, or down

- How to know if we are in a bull market, or a bear market (they say you are either bullish, or bearish - which is essentially the outlook or the risk appetite of the investor)

The topics in Technical Analysis is so wide-ranging, and I tell you - it could be very dangerous if you only cover a few and not all of the basics.

Just a disclaimer: what I'm gonna be showing you is just a few of the basics, hopefully I can cover some others in later posts.

On the other hand, the "fundamental analysis" aspect, in it's purest form, is different in that it doesn't rely on charts and graphs. It relies on price-to-earnings ratio, the earnings of the company (say in the last 4 quarters, or the last quarter, or assessments in the 1st or 2nd half of the year), if a company is indeed earning something, does a company have debt or incurred some losses, do they have incoming big projects that could boost it's stock value, etc.

Here is a tool that fundamentalists use:

Yep. I know, it's a newspaper. It's a basic tool. But I'm not saying it's not important. All the data in there are very very valuable, if you know how to use it. I'm saying that sometimes, you don't get the whole story with a full-page listing of the current stock prices.

The main difference, now, is that Technical Analysis uses charts & graphs. It uses projections graphically, using charts to see and justify those projections. Some higher topics even use formulas, and Da Vinci codes (no, I'm just kidding; but it's a bit true because they have what they call Fibonacci retracements).

Here is a sample tool of what Technical Analysts use. This is what they call a "Stock Chart" (this picture is our current Philippine Stock Composites Index, or PCOMP, at the time I wrote this post):

Technical Analysis basically says the value of a stock (from what the Fundamentalists state as the perceived price or fair value) is already priced-in on the 'stock-price' which we can squarely see on the charts, meaning if the stock did not perform well fundamentally, say: it didn't earn last quarter or has incurred some losses, it will show on the charts sooner or later. It will show that the stock price is gonna drop eventually.

That a movement on the price has some sort of a justification. Like for example, if a stock has suddenly moved up for no apparent reason, so that even fundamentalists can't explain it (say, a mining company just moved up so quick). Be careful because sooner or later that price is gonna drop. Nothing can sustain a momentum if that momentum has no substance.

Wow. I didn't realize that it's gonna take that long for me to explain things. But I just wanted to let people know that I want to be careful in describing abstract or intangible things, because I don't want to be an irresponsible writer who will get the ire of people. I want to explain the things I learn from my mentors as best as I can, and in the language that I know.

I consider myself still starting at business and investing, although I've been doing stocks for about 2 yrs already. I can be wrong at times (especially when I get to state some stocks which I think would be good to pick - if that happens in the future), but it's important to point out the things that already have a foundation, or, like what Stephen Covey says "a map of the reality, not the territory" - those things that are based on principles and are widely-considered as true, correct or objective. Just like the 2 schools of Stock Market Investing.

You can either be a pure fundamentalist, or a pure technical analyst. You can have balance between the two (which should be the correct way for most people, I should say - especially for those who are still starting & learning, or those who prefer less risks or those who have low-risk appetites or preferences), but these two are totally distinct and different approaches to Stock Market investing.

Sorry, I don't have anymore time for now. I will continue with this tomorrow, or as soon as possible, and try to evaluate the stock market (based on what COL has presented last night on their 2012 Stock Market Outlook), and how, like I said before, we will try to see Solar Systems as possibly a profitable investment - or may be a safer investment than most stocks, using charts analysis.

Monday, March 19, 2012

A Personal Study of our Home's Meralco Bills

First-off, I'd like to state what I've said on my last post, wherein I have promised to give you a sort of a comparison between investing in Stocks and investing in a Solar system:

“On my next post, let’s try to see how a Solar Investment can perform better than most stocks – using stock charting and comparable technical analysis.”

- 4 Reasons why Solar Power is the Next Generation Investment in the Philippines

I haven’t forgotten this, in fact I am still currently reviewing the current stocks performance of our Philippine Stocks Market at this time – and also I will be going to the 2012 CitisecOnline (COL) Market Outlook: "Get a Grip on the Market Insanity" tonight to get more info, so I may present it better. This will give me a better outlook as to the current situation of our Philippine stocks.

For now, let me give you a private study that I just conducted, based on the monthly electricity bills that we’ve had at home over the years. Please read on.

---------------------------------------------

Sometimes, the most unsuspecting recurring charges that we incur from our monthly or utility bills are the ones that are costing us the biggest chunk of were we could get our passive income.

Let's take for example our electricity bills.

Imagine how much your electricity would cost in a few yrs. Let me give you a sample: I have here a rundown of our electricity bill at home since around 2007 (yeah, I know.. I am junkie. I happen to keep utility bills in a folder).

Date: Sept 2007

Total kWh: 339

Amount: P3,206.65

Amount / kWh: 9.46

Ave Usage for 12 mos:

392 kWh/mo

127.16/day

Date: Feb 2009

Total kWh: 339

Amount: P3,186.85

Amount / kWh: 9.40

Ave Usage for 12 mos:

396 kWh/mo

125.63/day

Date: Apr 2009

Total kWh: 415

Amount: P4,375.70

Amount / kWh: 10.54

Ave Usage for 12 mos:

396 kWh/mo

126.16/day

Date: May 2009

Total kWh: 485

Amount: P4,693.20

Amount / kWh: 9.68

Ave Usage for 12 mos:

398 kWh/mo

126.10/day

Date: Jun 2009

Total kWh: 543

Amount: P5,066.80

Amount / kWh: 9.33

Ave Usage for 12 mos:

409 kWh/mo

129.68/day

Date: Dec 2011

Total kWh: 198

Amount: P2,114.25

Amount / kWh: 10.68

Ave Usage for 12 mos:

354 kWh/mo

131.97/day

Here is a summary of all the rates in a spreadsheet format, showing the amount and total kWh per month, since Sept. 2007 until Dec. 2011, which are the bills that we have for now on our home files (it's incomplete, as I can't find the other bills that I've had placed in a folder).

The yellow line on the graph shows the movement of the Rates or prices of Electricity per month.

The data, I have to admit, is a bit inconclusive (primarily due to the incompleteness of data). I was hoping to see if the rate inflation is increasing at a steady rate, but if we base our findings from here… I find that the rates are a bit unpredictable!

Which is all the more frightening.

Because, the price is fluctuating every month for some reason. There's no uniformity. And we don't get to see it easily until we get a closer look. On some months, the rate is higher. On some months, it's lower. It's like the crazy circus oil price hikes that poor rats (sorry, it's just satiric play) like us are subjected to every now and then.

Now, I don’t know if what I did is correct – but I computed for the rates for the Amount per kWh, by getting the Amount (Amount on the Bill) and divide it by Total kWh.

Here is the basic formula (using basic math):

Amount (Bill Amount)

--------------------------------- = Amount per kWh

Total kWh

If we base it on the average expense of our home, which is P4,249.07 (say, from Sept 2007 until Sept 2011).. this means we’ve already summed up around P203,955.20 in just 4 years?

Wow.

So this is the price of electricity in modern Filipino times. And I didn’t even know or realize it. Absolutely - nothing is free. In just 4 years, we’ve consumed and spent 200k worth of electricity!

That would have been a franchise fee for a Bayad Center or a reputable Foodcart business.

If we only knew, saving electricity and using less power consumption, then investing this amount of money in stocks, mutual funds or in a business would have gone a loooooong way.

Which is the next topic I am going to talk about, as I have promised before.

Stay tuned for my next post, which is using stock charts & graphs to see if a Solar System as an investment could outperform or is at par with the stocks in the Philippine Stock Market.

“On my next post, let’s try to see how a Solar Investment can perform better than most stocks – using stock charting and comparable technical analysis.”

- 4 Reasons why Solar Power is the Next Generation Investment in the Philippines

I haven’t forgotten this, in fact I am still currently reviewing the current stocks performance of our Philippine Stocks Market at this time – and also I will be going to the 2012 CitisecOnline (COL) Market Outlook: "Get a Grip on the Market Insanity" tonight to get more info, so I may present it better. This will give me a better outlook as to the current situation of our Philippine stocks.

For now, let me give you a private study that I just conducted, based on the monthly electricity bills that we’ve had at home over the years. Please read on.

---------------------------------------------

Sometimes, the most unsuspecting recurring charges that we incur from our monthly or utility bills are the ones that are costing us the biggest chunk of were we could get our passive income.

Let's take for example our electricity bills.

Imagine how much your electricity would cost in a few yrs. Let me give you a sample: I have here a rundown of our electricity bill at home since around 2007 (yeah, I know.. I am junkie. I happen to keep utility bills in a folder).

Date: Sept 2007

Total kWh: 339

Amount: P3,206.65

Amount / kWh: 9.46

Ave Usage for 12 mos:

392 kWh/mo

127.16/day

Date: Feb 2009

Total kWh: 339

Amount: P3,186.85

Amount / kWh: 9.40

Ave Usage for 12 mos:

396 kWh/mo

125.63/day

Date: Apr 2009

Total kWh: 415

Amount: P4,375.70

Amount / kWh: 10.54

Ave Usage for 12 mos:

396 kWh/mo

126.16/day

Date: May 2009

Total kWh: 485

Amount: P4,693.20

Amount / kWh: 9.68

Ave Usage for 12 mos:

398 kWh/mo

126.10/day

Date: Jun 2009

Total kWh: 543

Amount: P5,066.80

Amount / kWh: 9.33

Ave Usage for 12 mos:

409 kWh/mo

129.68/day

Date: Dec 2011

Total kWh: 198

Amount: P2,114.25

Amount / kWh: 10.68

Ave Usage for 12 mos:

354 kWh/mo

131.97/day

Here is a summary of all the rates in a spreadsheet format, showing the amount and total kWh per month, since Sept. 2007 until Dec. 2011, which are the bills that we have for now on our home files (it's incomplete, as I can't find the other bills that I've had placed in a folder).

Now, here is a summary of those rates in a Chart:

The yellow line on the graph shows the movement of the Rates or prices of Electricity per month.

Disclaimer:

This is a personal study. I am not a Statistics major, although I only know a few based on my experience as a Project Manager / Reports Specialist on my previous job. This may contain errors, but I tried to present the best way I can, as objective as I can, with the knowledge that I have. If anyone is willing to help or provide feedback especially on mistakes, please help me correct them so I may present better and more objective data. The truth is, all of these data came from our Meralco bills.

The data, I have to admit, is a bit inconclusive (primarily due to the incompleteness of data). I was hoping to see if the rate inflation is increasing at a steady rate, but if we base our findings from here… I find that the rates are a bit unpredictable!

Which is all the more frightening.

Because, the price is fluctuating every month for some reason. There's no uniformity. And we don't get to see it easily until we get a closer look. On some months, the rate is higher. On some months, it's lower. It's like the crazy circus oil price hikes that poor rats (sorry, it's just satiric play) like us are subjected to every now and then.

Now, I don’t know if what I did is correct – but I computed for the rates for the Amount per kWh, by getting the Amount (Amount on the Bill) and divide it by Total kWh.

Here is the basic formula (using basic math):

Amount (Bill Amount)

--------------------------------- = Amount per kWh

Total kWh

Now, here is a computation of the average amount, as well as the total amount generated for at least 4 years.

Ave Amt: P4,249.07

Ave Amt: P4,249.07

* This is our ave. monthly bill, based on the spreadsheet I've shown above.

Sample:

# years: 4

# months: 48

Total:

P203,955.20

* Ave. Amount x Number of Months

If we base it on the average expense of our home, which is P4,249.07 (say, from Sept 2007 until Sept 2011).. this means we’ve already summed up around P203,955.20 in just 4 years?

Wow.

So this is the price of electricity in modern Filipino times. And I didn’t even know or realize it. Absolutely - nothing is free. In just 4 years, we’ve consumed and spent 200k worth of electricity!

That would have been a franchise fee for a Bayad Center or a reputable Foodcart business.

If we only knew, saving electricity and using less power consumption, then investing this amount of money in stocks, mutual funds or in a business would have gone a loooooong way.

Which is the next topic I am going to talk about, as I have promised before.

Stay tuned for my next post, which is using stock charts & graphs to see if a Solar System as an investment could outperform or is at par with the stocks in the Philippine Stock Market.

Thursday, March 15, 2012

4 Reasons why Solar Power is the Next Generation Investment in the Philippines

Anything freely offered by nature (which means abundantly given by our creator), especially when u can harness one, means it's a gift from God.

That's how Solar Energy works. You can harness the natural power of the Sun to give electricity to your home. The Sun's energy is limitless, or according to scientists and physicists, it will last at least for more millions & millions, or maybe even billions, of years (I don't know the exact estimates).

The 4 Benefits of a Solar System:

1. It saves you money

- after the initial investment has been recovered, the energy from the sun is practically FREE.

2. Environmentally friendly

- Solar Energy is clean, renewable (unlike gas, oil and coal) and does not pollute the air by releasing carbon dioxides and other gases.

- Everyone, slowly but surely, is going environmental now... very soon, people will realize we need to take care of our environment. Sure, everyone wants to get rich, but no one wants to die.

3. It can be Independent/Semi-independently installed

- A solar power system can operate independently on your home, office or building, not requiring a connection to a power or gas grid at all: so that you are running fully on solar power alone

- It can also operate semi-independently, where only a few appliances or a few parts of a home can operate using Solar power, and the rest through the typical energy grid in your location

- Solar Panels have back-up batteries, so you can go full solo or semi-independently -- especially during times of storms

4. Low maintenance

- Solar panels have no moving parts, no recurring costs, do not release offensive smells and does not require you to add any fuel -- unlike Wind Energy which has engine parts or moving parts for it's turbines

- Solar Panels generally has a shelf life of 50 years, based on studies

- it's practically no cost after the initial investment (ROI) has been recovered.

How Solar Power works:

Why can we say it's an investment?

In financial terms, an investment is defined as:

1. The action or process of investing money for profit or material result.

2. A thing that is worth buying because it may be profitable or useful in the future.

By this definition, an investment can mean anything - a product, a service, an instrument, a stock, insurance, a company, a business, anything that potentially gives you back something in return in the future.

And so we can say, investing in Solar Power - be it through a solar-powered / environment-friendly company, a Solar Power Company stock (if there is one in PSE), or by using Solar Panels or Solar Systems themselves is surely profitable. Why? Because it removes, eradicates or lessens a critical part of a home or a company's cashflow: the EXPENSES.

And I can say it's a SAFE investment.

Because once you get ROI on your investment, it's gonna cost you savings. Huge and continuous savings.

As in... FREE electricity.

From the Sun.

Forever.

-------------

On my next post, let’s try to see how a Solar Investment can perform better than most stocks – using stock charting and comparable technical analysis.

Check my page on Facebook:

InvestingGeek on FB

Or join our community of Solar Enthusiasts on Facebook:

Solar Energy Philippines

That's how Solar Energy works. You can harness the natural power of the Sun to give electricity to your home. The Sun's energy is limitless, or according to scientists and physicists, it will last at least for more millions & millions, or maybe even billions, of years (I don't know the exact estimates).

The 4 Benefits of a Solar System:

1. It saves you money

- after the initial investment has been recovered, the energy from the sun is practically FREE.

2. Environmentally friendly

- Solar Energy is clean, renewable (unlike gas, oil and coal) and does not pollute the air by releasing carbon dioxides and other gases.

- Everyone, slowly but surely, is going environmental now... very soon, people will realize we need to take care of our environment. Sure, everyone wants to get rich, but no one wants to die.

3. It can be Independent/Semi-independently installed

- A solar power system can operate independently on your home, office or building, not requiring a connection to a power or gas grid at all: so that you are running fully on solar power alone

- It can also operate semi-independently, where only a few appliances or a few parts of a home can operate using Solar power, and the rest through the typical energy grid in your location

- Solar Panels have back-up batteries, so you can go full solo or semi-independently -- especially during times of storms

4. Low maintenance

- Solar panels have no moving parts, no recurring costs, do not release offensive smells and does not require you to add any fuel -- unlike Wind Energy which has engine parts or moving parts for it's turbines

- Solar Panels generally has a shelf life of 50 years, based on studies

- it's practically no cost after the initial investment (ROI) has been recovered.

How Solar Power works:

Why can we say it's an investment?

In financial terms, an investment is defined as:

1. The action or process of investing money for profit or material result.

2. A thing that is worth buying because it may be profitable or useful in the future.

By this definition, an investment can mean anything - a product, a service, an instrument, a stock, insurance, a company, a business, anything that potentially gives you back something in return in the future.

And so we can say, investing in Solar Power - be it through a solar-powered / environment-friendly company, a Solar Power Company stock (if there is one in PSE), or by using Solar Panels or Solar Systems themselves is surely profitable. Why? Because it removes, eradicates or lessens a critical part of a home or a company's cashflow: the EXPENSES.

And I can say it's a SAFE investment.

Because once you get ROI on your investment, it's gonna cost you savings. Huge and continuous savings.

As in... FREE electricity.

From the Sun.

Forever.

-------------

On my next post, let’s try to see how a Solar Investment can perform better than most stocks – using stock charting and comparable technical analysis.

Check my page on Facebook:

InvestingGeek on FB

Or join our community of Solar Enthusiasts on Facebook:

Solar Energy Philippines

Wednesday, March 14, 2012

See you at the 2012 COL Market Outlook: "Get a Grip on the Market Insanity"

CitisecOnline (COL) is going to hold another market briefing this Tuesday, March 20, 2012 at Meralco Theater, Ortigas (Pasig City) at 7PM MLA time:

2012 COL Market Outlook:

"Get a Grip on the Market Insanity"

"Get a Grip on the Market Insanity"

I'm joining to catch up with the latest buzz, even if I am out of circulation for now (with regard to my stocks investments):

With all the bullish hoopla, I'm pretty sure the place is all gonna be a frenzy:

Last time, Meralco Theater was packed. Mining stocks and companies like Lepanto Consolidated or "LC" was very hot then.

But this time, it's gonna be huge!!! Because the whole Philippine Stocks Exchange are a blazin'!

So, question.... are we in a bull market now?!?

See you there to find out!

Monday, March 12, 2012

Why you should go into Business

Why should you be looking into Business (Part-Time / Full-Time)?

Check on my Video below.

Check on my Video below.

I have conceptualized a system for reaching your Financial Goals. I call it the "Income Multiplication System".

The Income Multiplication System is a practical application of all the financial concepts and fundamentals that I've learned throughout the years.

It is based on what they call the Billionaire Wealth Building Formula from my very first blog post here:

I've tried, gone through, studied, and lost & gained from various businesses, income opportunities and financial instruments like Sales, MLM, Insurance, Philippine Stocks, Real Estate, among others.

This is a culmination of what I have learned and what I am hoping to build on, for a legacy that I want to leave for my future family.

Keep on working and building until you get passive income!

In the end, to God and Country be all the glory.

God Bless and more power to your business or to your full-time work!

Hey, let's have some fun from time to time!

Life is not always about work and business...

Sometimes, you gotta have fun! ;)

But of course, LIFE would be so much better once you attain a level where your PASSIVE INCOME exceeds your ACTIVE income - so that even when you are sleeping, playing or travelling the globe -- income just simply flows in!

Don't we want to have that kind of life? Wouldn't anyone want to have a 4-hour work week?

[Speaking of which, as an added value for my post today - you should read the book - "The 4-Hour Workweek" by Timothy Ferriss -- very highly recommended!]

(More info on the book at Amazon.com - see also notes below)

Living on PASSIVE INCOME should be our life's financial goal.

Because this is only when you can fully and genuinely enjoy your life's ultimate passion, whether it be basketball, music, dancing, gaming, gardening, tennis, guitar-playing, or simply going out with your friends and family to share good moments!

God bless!

Enjoy the current good times in NBA basketball - Miami Heat, Dwyane Wade, Lebron James, Chicago Bulls, Derrick Rose, Kobe Bryant, LA Lakers, Kevin Durant, Blake Griffin, Jeremy Lin.. bring it on!!!

-----------------------

Sometimes, you gotta have fun! ;)

Lebron James VS the NBA logo..

Who will win 1-on-1?

But of course, LIFE would be so much better once you attain a level where your PASSIVE INCOME exceeds your ACTIVE income - so that even when you are sleeping, playing or travelling the globe -- income just simply flows in!

Don't we want to have that kind of life? Wouldn't anyone want to have a 4-hour work week?

[Speaking of which, as an added value for my post today - you should read the book - "The 4-Hour Workweek" by Timothy Ferriss -- very highly recommended!]

(More info on the book at Amazon.com - see also notes below)

Living on PASSIVE INCOME should be our life's financial goal.

Because this is only when you can fully and genuinely enjoy your life's ultimate passion, whether it be basketball, music, dancing, gaming, gardening, tennis, guitar-playing, or simply going out with your friends and family to share good moments!

God bless!

Enjoy the current good times in NBA basketball - Miami Heat, Dwyane Wade, Lebron James, Chicago Bulls, Derrick Rose, Kobe Bryant, LA Lakers, Kevin Durant, Blake Griffin, Jeremy Lin.. bring it on!!!

-----------------------

NOTES about the book and the Author

The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich (Expanded and Updated)

"The 4-Hour Workweek" by Timothy Ferriss is the #1 New York Times bestseller and an international phenomenon.

This guide book teaches:

• How Tim went from $40,000 per year and 80 hours per week to $40,000 per month and 4 hours per week

• How to outsource your life to overseas virtual assistants for $5 per hour and do whatever you want

• How blue-chip escape artists travel the world without quitting their jobs

• How to eliminate 50% of your work in 48 hours using the principles of a forgotten Italian economist

• How to trade a long-haul career for short work bursts and frequent “mini-retirements”

• How Tim went from $40,000 per year and 80 hours per week to $40,000 per month and 4 hours per week

• How to outsource your life to overseas virtual assistants for $5 per hour and do whatever you want

• How blue-chip escape artists travel the world without quitting their jobs

• How to eliminate 50% of your work in 48 hours using the principles of a forgotten Italian economist

• How to trade a long-haul career for short work bursts and frequent “mini-retirements”

(More info on the book at Amazon.com)

TIMOTHY FERRISS, serial entrepreneur and ultravagabond, has been featured in the New York Times, National Geographic Traveler, Maxim, and other media. He speaks six languages, runs a multinational firm from wireless locations worldwide, and has been a world-record holder in tango, a national champion in Chinese kickboxing, and an actor on a hit television series in Hong Kong. He is twenty-nine years old.

Shop at Amazon.com!

TIMOTHY FERRISS, serial entrepreneur and ultravagabond, has been featured in the New York Times, National Geographic Traveler, Maxim, and other media. He speaks six languages, runs a multinational firm from wireless locations worldwide, and has been a world-record holder in tango, a national champion in Chinese kickboxing, and an actor on a hit television series in Hong Kong. He is twenty-nine years old.

Shop at Amazon.com!

Labels:

"The 4-Hour Workweek",

Active Income,

Chicago Bulls,

Derrick Rose,

Dwyane Wade,

Jeremy Lin,

LA Lakers,

Lebron James,

Miami Heat,

NBA basketball,

Passive Income,

Timothy Ferriss

Subscribe to:

Posts (Atom)